17 Affording a Healthier Tomorrow

Jasmine Sampson and Charlotte Corbitt

This chapter is based on the Social Ecological Model.

Families with low socioeconomic status (SES) face significant challenges when they lack financial stability. Parents may struggle to cope with financial hardships, fulfill their responsibilities, and regulate their emotions, which in turn affects the quality of caregiving they provide (Blair & Raver, 2016). The parent-child relationship is invaluable, but poverty and low SES can strain this bond. Additionally, the harmful effects of financial-related stress increase a child’s risk of low academic achievement, developmental or behavioral problems, and poor mental health (Blair & Raver, 2016). Low SES also exposes families to additional hardships that intensify into toxic stress. Families may be forced to move frequently, settle for unhealthy environments, or live in temporary spaces such as cars or hotels. They tend to skip health visits and opt for cheap but non-nutritious groceries, which can lead to chronic health conditions. On top of that, unexpected events, such as losing a job or loss of a loved one, can make it even more difficult for low-SES families to stay financially stable. When financial problems persist, parents may struggle to provide for their families and plan for their children’s future, continuing the cycle of financial instability.

Financial security shields families from economic hardships and ensures their children have opportunities to thrive. This chapter discusses solutions that can play a crucial role in protecting and strengthening financial security for all families, including low SES families. Advocating for these solutions ensures the well-being of communities, and everyone can have a role in supporting this effort.

Individual

Some barriers that prevent financial security stem from an individual’s attitudes and beliefs towards managing money. As a result, improving one’s financial situation begins with increasing their knowledge about finances. Research shows that financial literacy enhances decision-making skills, particularly among low-income families, and can lead to more stable financial situations (Fuji & White, 2024; Collins, 2010). Adults can improve financial literacy through free online courses like Khan Academy’s Financial Literacy course or educational content like books, podcasts, or financial newsletters (Boeing Employees’ Credit Union, 2025). These solutions equip parents with essential financial skills so that they can achieve financial well-being and provide for their children.

Relationship

Money management can be a complex skill, and some adults believe kids are too young to learn about money or that it is not the child’s responsibility. As a result, when children become adults, they are not prepared to pay off debt, save for emergencies, and invest for retirement. The lack of knowledge impacts their future parenthood decisions, which will only continue the cycle of financial hardship. The time children have with their caregivers allows many opportunities for them to learn good money habits. Research from the University of Michigan determined that children five years old and up have emotional reactions to money, which influence their financial behaviors (Smith et al., 2017). So, parents can start teaching their children as early as five years old about money.

Consistent teaching on saving, spending, and budgeting helps children develop the habits and confidence necessary for lifetime financial security. Initiating simple lessons, such as how to follow a budget while shopping or practicing self-control with an allowance, can teach kids how to be smart with money. Parents can also start piggy banks or set up bank accounts to encourage children to save (Federal Deposit Insurance Corporation, 2020). Additionally, caregivers should share lessons from their own experiences and lead by example.

Financial coaching that involves the entire family develops good financial habits across the lifespan. The Mobility Mentoring program encourages caregivers and children to work together to set financial and personal goals, building skills that support long-term stability. This program resulted in 80 percent of participants with maintained or improved self-sufficiency, financial stability, and personal development (The Family Partnership, n.d.).

Community

Workplaces, schools, and organizations can also increase financial security. Workplaces can help parents stay employed by offering childcare assistance or an on-site childcare center. Parents struggle to work or attend school when childcare options are unavailable or too costly. Good childcare not only helps families stay financially stable but also helps kids grow up healthier and do better in life (Sherman & Mitchell, 2019). Companies like Arthrex, a global medical device manufacturer, offer on-site childcare for children ages six months to a six-years-old that match Arthrex’s 6 a.m. to 4:30 p.m. work schedule (Holdman, 2023). Other businesses, like the Volvo Cars Ridgeville assembly plant, provide a $3,000 stipend for childcare (Holdman, 2023). Workplaces can also offer parents paid time off (PTO). Low-wage workers are less likely to receive PTO or have control over their work schedules, despite needing time off (Poydock, 2024). The lack of job-demand control makes it difficult for parents to make inflexible appointments, take care of themselves, and be present in their children’s lives (Conger, 2010).

Schools and educational organizations can host family events for financial literacy or offer workshops for parents on how to teach money management skills at home. All levels of education can implement personal finance courses in their curriculum. Local nonprofit organizations can administer programs that promote job training and higher education. The nonprofit, Prosperity Now (n.d.), provides a support network of finance experts and coaches, access to information on many topics like debt reduction, and events on asset-building. Goodwill Industries (n.d.) offers free career counseling, resume preparation, and job skills training in various industry sectors. Employers and nonprofits can also support GED programs or tuition assistance for college, as 72 percent of jobs in the US will require postsecondary education or training by 2031 (Gallegos, 2023, as cited in Georgetown University Center on Education and the Workforce, 2023). This community support gives parents the chance to build self-sufficiency, find higher-paying jobs, and prepare for future financial challenges (United Way, n.d.).

Affordable housing strengthens families’ financial security. Local nonprofits, such as Front Porch Housing and Homes of Hope, actively provide affordable housing (Front Porch Housing, n.d.; Homes of Hope, n.d.). Organizations can start community land trusts (CLTs) where they buy land and then lease it at an affordable price to families to build their homes (Freddie Mac, 2024). CLTs have been shown to improve housing stability over a five-year period compared to non-CLT homeowners (Schneider et al., 2022). CLT homeowners also report fewer financial hardships (Schneider et al., 2022). Additionally, organizations can support families with their homeownership journey, like the American Pledge Foundation (AmPledge). AmPledge helps families find and finance their homes and stay in their homes during difficult times with their down payment and hardship assistance programs (American Pledge Foundation, n.d.).

Societal

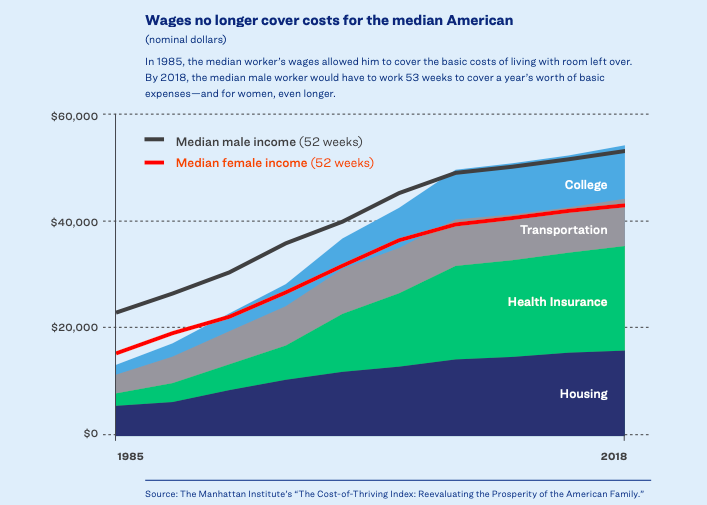

The state and federal governments can take action today to help with financial security. Increasing federal and state minimum wages can ensure that workers earn an income to cover the costs of living. Over 21 million renters spend more than 30% of their income on housing costs, and 12 million renters spend more than 50% of their income on housing (Kaysen, 2024, as cited in Joint Center for Housing Studies of Harvard University, 2024). When families spend a bulk of their paycheck on housing, they have a hard time paying for clothing, healthy foods, doctor visits, and transportation. Governments can also increase funding for the Child Care and Development Fund (CCDF), which requires states to plan and implement programs that help low-income families access quality childcare (Office of Child Care, 2025).

Robust child tax credits are a proven solution to help families manage financial burdens. In 2021, the U.S. federal government passed a bill that provided monthly cash assistance to qualifying families to help manage unpredictable incomes and expenses during the pandemic. This bill lifted about three million children out of poverty in that year alone (Burns & Fox, 2022). Cash assistance gives parents more freedom as they know best how to support their children compared to programs such as the Supplemental Nutrition Assistance Program (SNAP) that limit a parent’s choice in what foods they can buy (Gennetian & Magnuson, 2022).

State laws mandating financial literacy classes can encourage financial security. Financial education in high school improves credit scores, lowers loan rates, and steers students away from costly services like payday loans (Carrns, 2023). However, only 26 states currently require students to take a personal finance course to graduate, leaving room for improvement for all high school students nationwide (Hensley, 2024).

Key Takeaways

- Free resources are available to improve one’s finances, but individuals must take the initiative and have access to the internet or a public library.

- Involving the entire family in financial literacy builds financial security among caregivers and children, leading to a healthier, more stable life.

- The community can step up to help its members with financial security, especially when the government is slow to act or unable to support everyone in need.

- The government can implement policies right now to help individuals achieve a better economic status instead of just helping them get by.

References

Administration for Children and Families. (2025). OCC fact sheet. Office of Child Care. https://acf.gov/occ/fact-sheet

American Pledge Foundation. (n.d.). How we help you. https://www.ampledge.org/

Blair, C., & Raver, C. C. (2016). Poverty, stress, and brain development: New directions for prevention and intervention. Academic Pediatrics, 16(3), 30–36. https://doi.org/10.1016/j.acap.2016.01.010

Blossom, P. (2023, October 17). What are the benefits of free school meals? Here’s what the research says. Food Science & Human Nutrition; University of Illinois. https://fshn.illinois.edu/news/what-are-benefits-free-school-meals-heres-what-research-says

Boeing Employees’ Credit Union. (2025). Six ways to help improve your financial literacy. BECU. https://www.becu.org/articles/six-ways-to-help-improve-your-financial-literacy

Collins, J. M. (2013). The impacts of mandatory financial education: Evidence from a randomized field study. Journal of Economic Behavior & Organization, 95, 146–158. https://doi.org/10.1016/j.jebo.2012.08.011

Conger, R. D., Conger, K. J., & Martin, M. J. (2010). Socioeconomic status, family processes, and individual development. Journal of Marriage and Family, 72(3), 685–704. https://doi.org/10.1111/j.1741-3737.2010.00725.x

Carnevale, A. P., Smith, N., Van Der Werf, M., & Quinn, M. C. (2023). After everything: Projections of jobs, education, and training requirements through 2031. Georgetown University Center on Education and the Workforce. https://cew.georgetown.edu/wp-content/uploads/Projections2031-National-Report.pdf

Carrns, A. (2023, December 1). More states now require financial literacy classes in high schools. The New York Times. https://www.nytimes.com/2023/12/01/your-money/financial-literacy-high-school-students.html

Federal Deposit Insurance Corporation. (2020, September). Teaching children about money now pays dividends later. https://www.fdic.gov/consumer-resource-center/2020-09/teaching-children-about-money-now-pays-dividends-later

Freddie Mac. (2024). How community land trusts can make homebuying more affordable. My Home. https://myhome.freddiemac.com/blog/homebuying/how-community-land-trusts-can-make-homebuying-more-affordable

Front Porch Housing. (n.d.). Our work. https://www.frontporchhousing.org/our-work.

Fuji, K. T., White, N. D., Packard, K. A., Kalkowski, J. C., & Walters, R. W. (2024). Effect of a financial education and coaching program for low-income, single mother households on child health outcomes. Healthcare, 12(2), 127–127. https://doi.org/10.3390/healthcare12020127

Gallegos, E. (2023, November 16). Report: 72% of jobs will require more than a high school diploma in 2031. EdSource. https://edsource.org/updates/report-72-of-jobs-will-require-more-than-a-high-school-diploma-in-2031

Hensley, B. J. (2024, August 19). Respect legislative intent with youth financial education requirements. National Endowment for Financial Education. https://www.nefe.org/news/2024/08/respect-legislative-intent-with-youth-financial-education-requirements.aspx

Holdman, J. (2023, November 14). More SC companies offering child care benefits to attract workers. SC Daily Gazette. https://scdailygazette.com/2023/11/14/more-sc-companies-offering-child-care-benefits-to-attract-workers/

Homes of Hope. (n.d.). Affordable housing. https://homesofhope.org/affordable-housing/

Kaysen, R. (2024, January 25). More renters than ever before are burdened by the rent they pay. The New York Times. https://www.nytimes.com/2024/01/25/realestate/rent-prices-housing.html

Pearce, A., & Neal, A. (2023, September 26). Challenges and opportunities of providing free school meals for all. Center for American Progress. https://www.americanprogress.org/article/challenges-and-opportunities-of-providing-free-school-meals-for-all/

Poydock, M., Rhinehart, L., & McNicholas, C. (2024, July 23). Flexible work: What workers, especially low-wage workers, really want and how best to provide it. Economic Policy Institute. https://www.epi.org/publication/flexible-work/

Prosperity Now. (n.d.). Financial security network. https://www.prosperitynow.org/get-involved

Schneider, J., Lennon, M., & Saegert, S. (2022, February 21). Do community land trusts improve resident outcomes? Housing Matters. https://housingmatters.urban.org/research-summary/do-community-land-trusts-improve-resident-outcomes

Smith, C. E., Echelbarger, M., Gelman, S. A., & Rick, S. I. (2017). Spendthrifts and tightwads in childhood: Feelings about spending predict children’s financial decision making. Journal of Behavioral Decision Making, 31(3), 446–460. https://doi.org/10.1002/bdm.2071

The Family Partnership. (n.d.). Mobility mentoring. https://www.thefamilypartnership.org/our-approach/mobility-mentoring/.

United Way of Greenville County. (n.d.). Financial stability. https://www.unitedwaygc.org/impact/financial-stability/

Encompasses not only income but also their education, job status, and social status. SES affects the quality of life people have and the opportunities they get.

The relationship between an individual and their biological offspring or between an individual and a child he or she has legally adopted.

When an individual is in a constantly recurring stressful situation that causes a prolonged stress response in the brain and body.

The ability to understand and effectively use various financial skills, including personal financial management, budgeting, and investing

How job demands and the level of control affect stress levels and job satisfaction

General equivalency diploma; used for educational testing services designed to provide a high school equivalency credential

A federal program that provides food benefits to low-income families to supplement their grocery budget so they can afford the nutritious food essential to health and well-being

Money that is lent to someone by a company for a short time at a very high rate of interest