Economy and Finance

84 Effect of Social Media on the Stock Market

Tess Neary and gkoceni

Introduction

Over the past decade, we have seen an exponential rise of social media, with nearly every American today having access to it, spending on average 2 hours and 23 minutes per day consuming content (Soax, 2024). This has only increased as the algorithms get more effective and more people get drawn in. So, how does this affect the stock market?

Social media apps like Instagram, YouTube, Reddit, etc. allow people to share what stocks they are investing in, and creators with a big following can cause an avalanche of people to follow their moves, causing a stock to greatly increase or decrease in value. The effects of this are especially seen in smaller cap stocks, where only a little bit of buying pressure can cause the stock to double, triple, or even 10x its value in short periods of time. Most of the time, the gains in these stocks don’t last very long because people end up selling to cash out, while some people are left in the dust, losing lots of money after buying the stock at its peak. This has created a lot of volatility in the stock market in recent years.

Along with the influence of social media causing increased volatility, investing apps like Robinhood and Coinbase have made investing more accessible to everyday people, as apps like these have set the precedent for commission-free trading. This has allowed the everyday person to trade whenever they want, while in the past, investing was more focused on the long term as investing firms charged a commission every time you bought a stock, making it impractical to buy and sell on a daily basis. While this is great for empowering small investors, this, along with social media influence, can also lead to overhyped stocks, causing their prices to skyrocket and then crash when people start selling. This has created bigger risks, but it also shows how regular investors can work together to challenge the power of big Wall Street firms through collective, organized moves like short squeezes.

Connection to STS:

The effect of social media on the stock market is connected to STS in many ways. First, we have had significant technological advancement in social media, with platforms like Twitter, Reddit, and YouTube, along with trading apps like Robinhood, that enable the rapid spread of financial information and influence. Everyone now has a phone to access this information, and this is thanks to technological innovation. Second, social media fosters communities where individuals share ideas and strategies. This leads to collective actions of people putting money into the same stock, which reflects how technology shapes societal behaviors and group dynamics. Finally, this new era of social media influence allows society to challenge traditional systems and create more economic opportunities for working-class people in our society. Social media platforms like Instagram, Facebook, and YouTube have changed the way people invest. A recent study of Angel Broking users in Tumkur, India found that younger investors, especially those with less experience, often make investment decisions based on what they see online (Kumar & Mayya, 2024). This shows how technology doesn’t just give people access to financial informat

ion, it actually shapes how they think and act when it comes to money. The study also found that emotions play a big role. Many people said they’ve felt excited or nervous because of something they saw on social media, and this led them to make quick decisions, like buying or selling a stock. The influence of social media creators and influencers is especially strong, with many investors saying they follow advice from people online rather than from traditional sources. This shows how society is changing, with everyday people getting more involved in the market thanks to social media, but also facing new risks

because of it.

Figure 2: AI-generated image showing the power of retail investors using social media and trading apps to influence the stock market.

Chapter Content/Quotes/Examples:

Social media had been around since the early 2000s, but when did it really start effecting the stock market? People have always been trading stocks, but it was mainly the older generations, however in early 2020 that all changed. Covid-19 shocked the world, and with that, the stock market crashed almost instantly and created many buying opportunities. When everyone realized that COVID wasn’t the end of the world and companies were able to conduct business again, stocks skyrocketed back up, and this was when younger people who were more risk takers with their money jumped in and started investing. Younger people, who are more social media friendly, started sharing their moves and investments online, creating groups that would talk about specific stocks that they were hopeful and confident about being successful. This led young investors to discover what a short squeeze was. This is a situation in the stock market where a heavily shortedstock rapidly increases in price, forcing short sellers to buy back the stock to cover their positions, leading to a huge increase in stock price. Most of these short positions are held by big Wall Street hedge fund managers, betting money on a stock to lose value and go out of business. This led to someone finding GameStop, a stock that a lot of people on Wall Street thought was going to go out of business because of COVID-19. In early 2021, people on Reddit started posting about this stock and got millions of people to invest in it, which caused the stockprice to skyrocket as the Wall Street investors who were shorting it before had to sell their shorts to buy the stock, which caused it to go up even higher. The U. S. Securities and Exchange Commission states that “GameStop Corp and multiple other stocks experienced a dramatic increase in their share price in January 2021 as bullish sentiments of individual investors filled social media.” (Biancotti, 2021) This caused the stock price to go from around 10$ to around 400$ in a matter of days. This made some individuals millions of dollars.

The screenshot above is from one of the investors on Reddit, showing gains of millions of dollars. The millions of dollars regular working-class people made from this event came straight out of the pockets of the billionaires on Wall Street. This one occasion convinced millions of individual investors that if they all gathered together, they could have more power than Wall Street hedge funds.

Supporting this, Erbelding (2022) explains that the GameStop event was a new type of financial bubble — one that was “inflated on purpose and with exactly this intention” (p. 1). He describes how the event showed the power of social media to influence stock prices through group action, not just financial data. His research shows that regular people, also called retail investors, often rely on social media for investing ideas and are heavily influenced by things like hype and emotion. These kinds of reactions can make stock prices rise or fall even if the company itself hasn’t changed. Erbelding says this behavior comes from things like “limited attention and investor sentiment,” which are common in behavioral finance (p. 1).

This goes against the traditional view that markets are always logical and that prices reflect all known information. The GameStop story showed that group behavior online can shift markets in unexpected ways. It also sent a message to Wall Street that everyday people now have tools — like Reddit, Twitter, and trading apps — to challenge their control. What started as an internet joketurned into a serious financial event, showing how social media and technology are changing who has power in the stock market.

Another way social media affected the stock market was when Elon Musk started tweeting about dogecoin and how it was the future of currency. This skyrocketed the price of this crypto called dogecoin, which went up thousands of percent. This put into question whether some people with big following have too muchinfluence over the markets.

A study by Chahine and Malhotra (2018) found that the way companies communicate on platforms like Twitter has a direct impact on how investors react. Specifically, firms that used two-way communication strategies — where they actively interact with followers — saw greater positive reactions in their stock prices than those that only posted one-way updates. This shows that people value real interaction and transparency over simple broadcasting. Their research also suggests that interactive communication builds trust and credibility, while one-way messages can come off as promotional or manipulative. These findings support the idea that how a message is delivered on social media can matter just as much as the message itself, especially when money is involved.

These events put into question whether the use of social media to promote a stock could be considered market manipulation. The U.S. Securities and Exchange Commission (SEC) investigated both these situations and came to the conclusion that a collective action like the GameStop event can’t be controlled and that regulation would have to go both ways between retail investors and Wall Street hedge funds, even though Wall Street was pushing for more regulation on retail investors after this event. A lot of retail investors also spoke out about insider trading on Wall Street and how shorting a stock really hurts a company. From this, since January 2, 2024, “Managers will have to report a monthly average of daily gross short positions if they are at least $10million or 2.5% of the issuer's outstanding shares.” (Shipov, 2024) The SEC also investigated Elon Musk for his tweets on Dogecoin and concluded that crypto is a speculative asset, making it hard to enforce any rules. Elon Musk also said he was tweeting about it as a joke, also negating any further information that he was using it to make money.

One of the missing voices in the investing world is women, as in the past, men were typically in charge of household finances. Recently, however, “67% of women were investing outside of their retirement accounts, up from 44% in 2018.” (Fidelity Investments). This is a step in the right direction, but in higher-up financial management, women are still highly underrepresented. According to a report from investment research firm Morningstar, “Only about 12.5% of portfolio managers across funds based in the United States are female, almost unchanged from ten years ago,” and “As of the end of last year, just about 26% of over 10,000 funds in the United States were led by a team that included at least one woman.” (Reuters, 2023)

One of the biggest women voices in the investing world that has emerged is Cathie Wood. Her voice has emerged as she has a unique way of looking at investing, where she only invests in companies that have disruptive innovation, which many people look at as being riskier investments as they are usually newer companies. She also likes to buy when stocks are dropping, which is also very different than many investors, as

most people only invest when prices are going up. “Cathie Wood invests in disruptive innovation, but that isn’t her only strategy. She also chooses opportunities that others turn their noses up at – when share prices drop, she buys in” (Financhill, 2024). She has a more high-risk, high-reward strategy. “In 2021, Cathie Wood's ARK Innovation ETF (ARKK) experienced significant gains in line with broader trends in technology and innovation-driven stocks. During that year, ARKK achieved a 55% year-to-date gain, outperforming major benchmarks like the Nasdaq 100” (Nasdaq). Cathie Wood has turned heads in the investing world as people may want to consider investing in a women-led hedge fund rather than other hedge funds. It is not new that women usually outperform men in the stock market as A more recent Fidelity study shows “women outperforming men by 40 basis points or 0.4%” (Hagan, 2024), with some studies showing they outperform men by over 1% on a year-to-year basis. This is likely due to women being more patient, waiting for opportunity rather than jumping into something without much research. Women are also likely to remain calm during market volatility, with Fidelity stating that “Women were 8% more likely to wait out market volatility than men.” (Hagan, 2024). This research should encourage more people to trust women with their finances. Theonly reason Cathie Wood was able to accumulate such a big following in the investing world was because of her use of social media. She is one of the few hedge fund managers who regularly goes on podcasts and posts on social media about specific positions she is taking, and this has allowed her to beat the odds and be successful as a women manager.

most people only invest when prices are going up. “Cathie Wood invests in disruptive innovation, but that isn’t her only strategy. She also chooses opportunities that others turn their noses up at – when share prices drop, she buys in” (Financhill, 2024). She has a more high-risk, high-reward strategy. “In 2021, Cathie Wood's ARK Innovation ETF (ARKK) experienced significant gains in line with broader trends in technology and innovation-driven stocks. During that year, ARKK achieved a 55% year-to-date gain, outperforming major benchmarks like the Nasdaq 100” (Nasdaq). Cathie Wood has turned heads in the investing world as people may want to consider investing in a women-led hedge fund rather than other hedge funds. It is not new that women usually outperform men in the stock market as A more recent Fidelity study shows “women outperforming men by 40 basis points or 0.4%” (Hagan, 2024), with some studies showing they outperform men by over 1% on a year-to-year basis. This is likely due to women being more patient, waiting for opportunity rather than jumping into something without much research. Women are also likely to remain calm during market volatility, with Fidelity stating that “Women were 8% more likely to wait out market volatility than men.” (Hagan, 2024). This research should encourage more people to trust women with their finances. Theonly reason Cathie Wood was able to accumulate such a big following in the investing world was because of her use of social media. She is one of the few hedge fund managers who regularly goes on podcasts and posts on social media about specific positions she is taking, and this has allowed her to beat the odds and be successful as a women manager.

Conclusion:

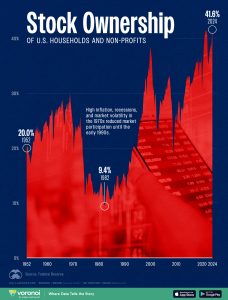

Both the stock market events described above were solely driven by the power of social media, and there are both positives and negatives to this. The positives of this are that it gives people the power to voice their opinions and gives positive light to the power of investing and saving for their future. Social media and commission-free investing apps have allowed stock ownership to skyrocket to an all-time high, which is good for everyday people saving for their future. It also gives working-class people the power to challenge wall-street billionaires and the power they have over the stock market. Social media has also allowed missing voices to gain trust in the investing world. Some negatives to social media are that it causes concern for market manipulation from creators with a big following, and it has made the stock market more volatile in recent years, with more short-term investors rather than long-term investors.

chapter questions:

1. How has social media changed the way everyday people invest in the stock market?

2. What is a “short squeeze,” and how did it help regular investors challenge Wall Street during the GameStop event?

3. What are some benefits and risks of getting stock advice from influencers or creators online?

4. How does Cathie Wood’s story show how social media can help underrepresented voices gain influence in finance?

5. Do you think the stock market should have more rules about what people can post on social media? Why or why not?

References:

- Soax. What’s the Average Time Spent on Social Media Each Day? (2024). https://soax.com/research/time-spent-on-social-media#:~:text=Research%20highlights%3A%20On%20average%2C%20people,spent%20scrolling%20through%20different%20platforms. (accessed 2024-12-12).

- Rohanshah. The Influence of Social Media on Stock Market Trends. https://medium.com/@rohanshah0502/the-influence-of-social-media-on-stock-market-trends-feed4365f64e (accessed 2024-12-12).

- J. Cunningham. https://sites.suffolk.edu/jhtl/2023/02/22/the-increasing-influence-of social-media-on-the-stock-market/ (accessed 2024-12-12).

- Claudia Biancotti. Financial Markets and Social Media: Lessons from Information Security. (2021). https://carnegieendowment.org/research/2021/11/financial-markets-and social-media-lessons-from-information-security?lang=en (accessed 2024-12-12).

- Shipov, P. How Did Hedge Funds Lose Money on GameStop. https://hedgefundalpha.com/how-did-hedge-funds-lose-money-on-gamestop/ (accessed 2024-12-12).

- SEC Staff Releases Report on Equity and Options Market Structure Conditions in Early 2021. https://www.sec.gov/newsroom/press-releases/2021-212 (accessed 2024-12-12).

- Reuters. https://www.reuters.com/article/us-hedgefunds-women-insight/women-running the-money-rarely-at-hedge-funds-idUSKCN1RA0VF/ (accessed 2024-12-12).

- Financhill. The Cathie Wood Effect. https://financhill.com/blog/investing/the-cathie-wood-effect (accessed 2024-12-12).

- 24, A.; Hagen, K.; The Motley Fool Founded in 1993 in Alexandria. Women Outperform Men as Investors, Statistics Show. Here Are 3 Possible Reasons. https://www.nasdaq.com/articles/women-outperform-men-investors-statistics-show-here-are-3-possible-reasons (accessed 2024-12-12).

- The first image was created using Leonardo AI. Leonardo.AI

Erbelding, S. (2022). The influence of social media on the stock market* (Bachelor’s thesis, Metropolia University of Applied Sciences). https://www.theseus.fi/bitstream/handle/10024/798627/Erbelding_Sascha.pdf?sequence=2

Kumar, N. T. S., & Mayya, S. (2024). The impact of social media on investors’ decision-making in the stock market: A case study of Angel Broking users in Tumkur. International Journal for Multidisciplinary Research, 6(3). https://doi.org/10.36948/ijfmr.2024.v06i03.23550

Chahine, S., & Malhotra, N. K. (2018). Impact of social media strategies on stock price: the case of Twitter. European Journal of Marketing, 52(7/8), 1526–1549. https://www.emerald.com/insight/content/doi/10.1108/ejm-10-2017-0718/full/html

images:

Figure 2 Leonardo.Ai. (2024). Retail investors using social media to drive stock prices [AI-generated image]. https://leonardo.ai

Alt Text:

A digital illustration showing a smartphone screen with a rising stock chart, surrounded by glowing social media icons like Reddit, Twitter, and YouTube. A crowd of everyday people stands in the background holding up phones, symbolizing the collective influence of retail investors.